Digital HELOC

Apply online. Fast approval.

Unlock a $50k-$500k line of credit

Access up to 90% of property value2

Available for primary, second, and investment homes

Introducing

exclusively at Better

Instead of waiting weeks, now you can lock a rate, share some financial info, and get a loan Commitment Letter within the next 24 hours.1

Customers must qualify. Terms Apply

Buy a home

Unlock a $50k-$500k line of credit

Access up to 90% of property value2

Available for primary, second, and investment homes

Apply 100% online, on your schedule

No commissions

Close 17 days faster than industry avg.

$2k off Better Mortgage closing costs3

Local expert knowledge

Seamless communication with Better Mortgage

We needed to make an offer the next day. Better made it happen.

Protect your home and yourself

Find savings on home, auto, life insurance, and more

Highly rated local attorneys

Vetted by homebuyers like you

Get matched in minutes

Better Settlement Services

Title & Closing

No unnecessary fees

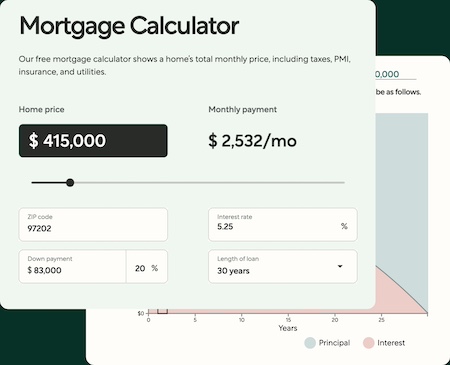

Use our mortgage calculator to estimate your monthly payments, including key factors like homeowners association fees, property taxes, and private mortgage insurance.

Try the calculator

Image is for example purposes only. Your actual rates, monthly payment, and loan amount will vary.

We did the math on the next 30 years. It was cheaper to own.

Almost half of all homebuyers don’t compare mortgage lenders before locking a rate. But small rate differences can add up to big savings.

When you apply for a mortgage, the top three things lenders look at are your income, your credit score, and your debt-to-income ratio, or DTI.

Housing prices are rising across the country, and low down payment mortgages make it easier for homebuyers to enter the housing market.